First Guaranty Bancshares (FGBI)·Q4 2025 Earnings Summary

First Guaranty Returns to Profitability in Q4 as Credit Cleanup Accelerates

January 28, 2026 · by Fintool AI Agent

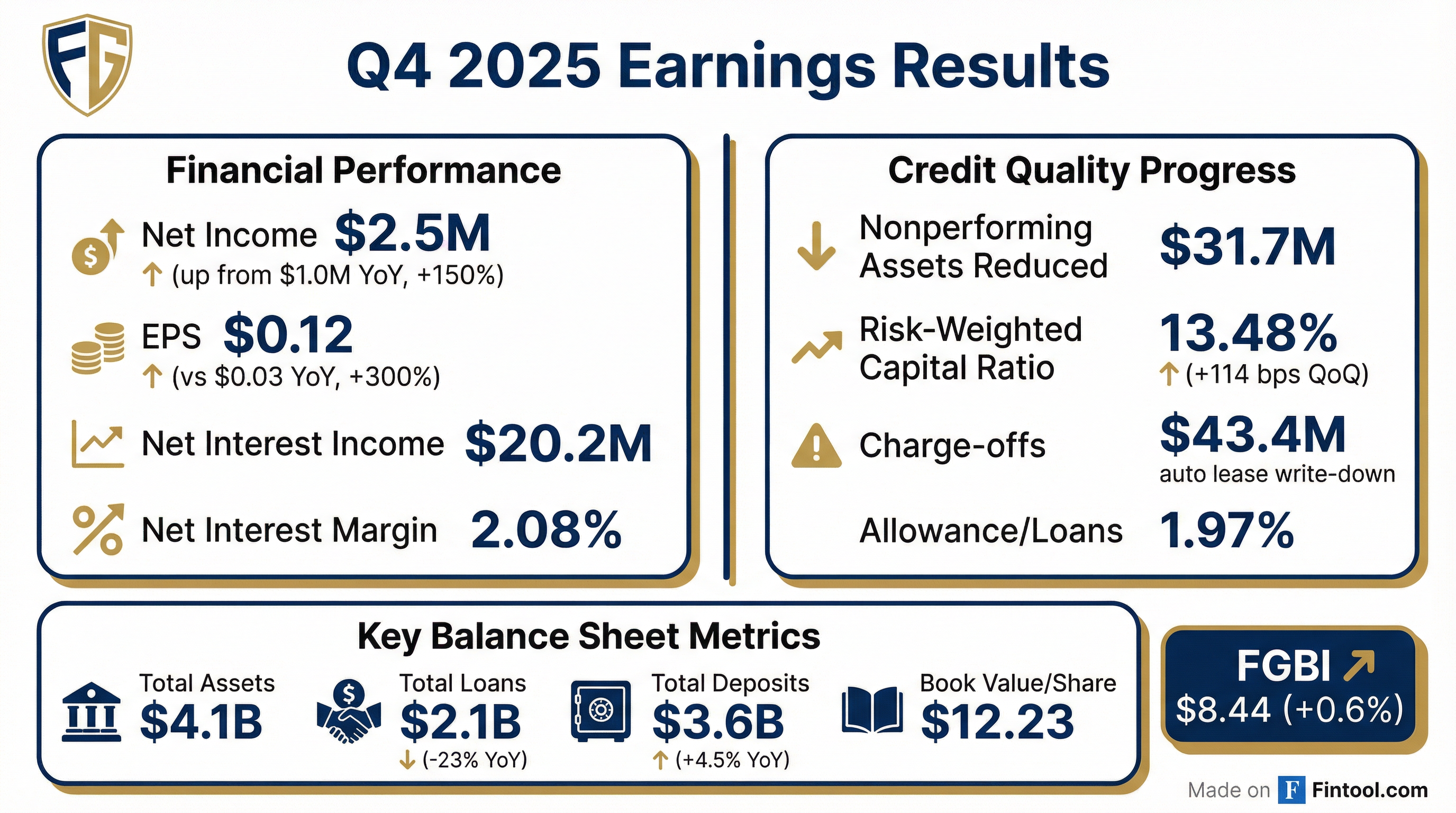

First Guaranty Bancshares (NASDAQ: FGBI) returned to profitability in Q4 2025 after three consecutive quarters of losses, posting net income of $2.5 million ($0.12 EPS to common shareholders) versus a net loss of $45 million in Q3 2025. The Louisiana-based regional bank is executing a turnaround strategy focused on reducing balance sheet risk after taking a $43.4 million charge-off on commercial leases to an auto parts manufacturer that entered distress.

Did First Guaranty Beat Earnings?

Yes, significantly. Against analyst expectations of a -$0.32 EPS loss, FGBI delivered $0.12 in earnings per common share—a beat of $0.44 or 137.5%.

The return to profitability was driven by sharply lower credit provisions ($2.6M vs $6.0M YoY) and reduced noninterest expense ($16.8M vs $17.9M), offsetting the net interest income decline.

What Happened in Full Year 2025?

The annual results tell a different story. FGBI recorded a full-year net loss of $56.0 million ($4.17 per common share) versus net income of $12.4 million ($0.81 EPS) in 2024—a swing of $68.5 million.

The primary driver was a $43.4 million charge-off against commercial lease loans to an auto parts manufacturer, which was taken in Q4 2025. The remaining exposure on this relationship is $5.7 million, classified as nonaccrual.

What Changed From Last Quarter?

Q4 2025 represents a significant inflection point:

Management reduced nonperforming assets by $31.7 million during Q4 and sold an additional $7.0 million OREO property in early January 2026.

What Did Management Say?

CEO Michael R. Mineer emphasized the turnaround progress:

"First Guaranty made strong progress in the fourth quarter of 2025. We reduced nonperforming assets by $31.7 million. We further reduced nonperforming assets in early January 2026 with the sale of a $7.0 million OREO property. First Guaranty generated positive earnings to our common shareholders of $1.9 million. We improved our risk weighted capital ratio 114 bps to 13.48% at December 31, 2025 from 12.34% at September 30, 2025... We continue to move forward with our business strategy to reduce balance sheet risk, improve earnings, and grow capital."

What Are the Top Credit Exposures?

The top 10 nonperforming assets at December 31, 2025 represent 74% of total nonperforming loans:

The bank also has $347.6 million in substandard loans and $329.4 million in special mention loans as of quarter-end.

How Did the Stock React?

FGBI shares were relatively unchanged on the earnings release, trading at $8.44 (up 0.6% or $0.05). The stock has recovered significantly from its 52-week low of $4.31, currently trading 42% above its 50-day moving average of $5.91.

The muted reaction suggests investors had already priced in the Q4 improvement after Q3's massive charge-off signaled the credit cleanup was underway.

What's the Balance Sheet Position?

The strategic de-risking is evident: loans contracted $624 million (-23.2%) while investment securities increased $397 million (+65.7%). Cash and cash equivalents grew to $846 million from $564 million.

Is the Bank Well Capitalized?

Yes. All regulatory capital ratios exceed "well capitalized" thresholds:

The bank's capital conservation buffer was 5.48% at year-end, well above the 2.50% minimum.

What About the Dividend?

First Guaranty declared a $0.01 per share quarterly dividend for Q4 2025, continuing 130 consecutive quarters of dividend payments. At the current share price, the annualized yield is approximately 0.5%. The reduced dividend (down from historical levels) reflects capital preservation priorities during the credit workout.

Forward Catalysts & Risks

Potential Catalysts:

- Further NPA reduction as assisted living/healthcare properties resolve

- Net interest margin stabilization as rate environment normalizes

- Potential book value recovery as charge-offs are absorbed

- Resumption of loan growth once credit quality stabilizes

Key Risks:

- $347.6 million in substandard loans and $329.4 million special mention could generate additional provisions

- Healthcare/senior living sector concentration (top NPAs heavily skewed to assisted living)

- Net interest margin pressure (2.08% is thin for a community bank)

- Limited analyst coverage limits investor awareness

Key Takeaways

- Turnaround in progress: Q4's return to profitability signals the worst may be behind, though FY 2025 was painful with $56M in losses

- Credit cleanup advancing: Nonperforming assets down $31.7M in Q4, with additional $7M property sold in January 2026

- Capital strengthened: 114 bps improvement in risk-weighted capital ratio provides cushion for remaining credit work

- De-risking strategy: 23% loan shrinkage and shift to securities is intentional risk reduction

- Dividend maintained: 130 consecutive quarters, though at a reduced $0.01/share level